The Government’s Pension Dashboard project is suspected of sloping off towards the long grass. The earliest date had already been pushed out to 2019. We aim to beat that with an interactive dashboard for prospects (as a test drive) and clients by Christmas 2018.

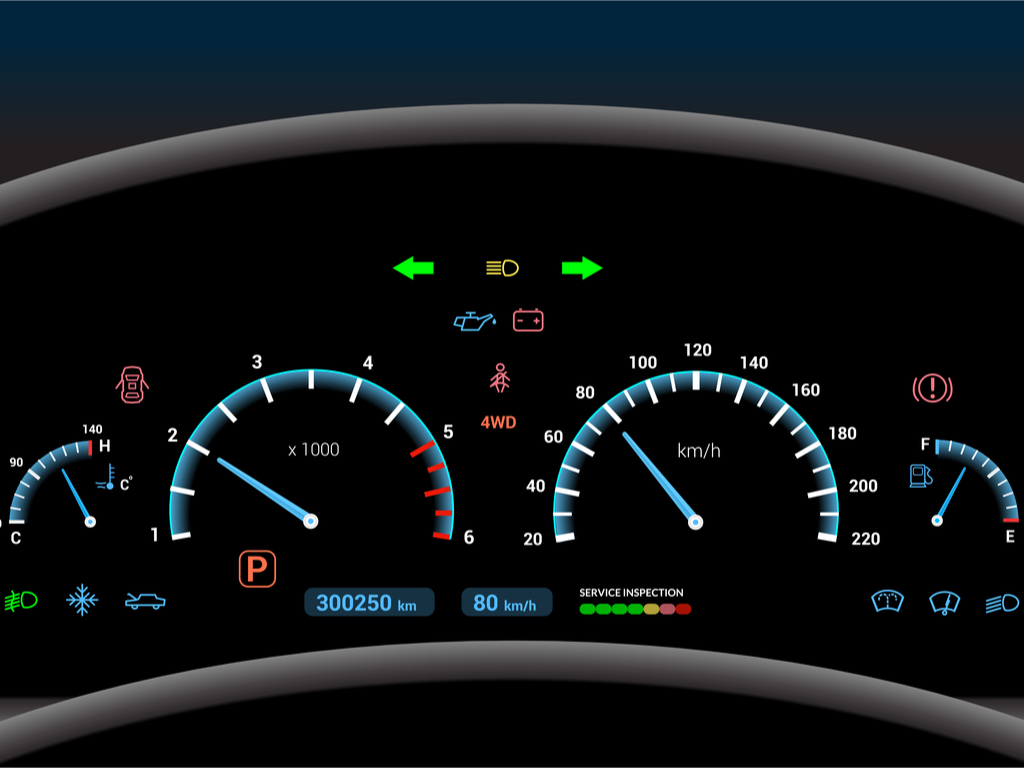

What’s on our interactive dashboard?

– All sources of wealth or future spending

– Goal-specific outcomes in terms clients can relate to, such as total after-tax retirement spending

– Prompts to improve planning as a function of changing market values or client circumstances.

The dashboard is already used with Fowler Drew clients but currently only our advisers have access to the data. The test drive allows prospects to make plans guided by questions and prompts in the user interface. (It’s not the first goal based planning tool we’ve shared online: that was a Defined Benefit transfer tool – which allows deferred members to understand the range of drawdown outcomes resulting from transfer.) The client version of the interface, to which saved prospect data can (with GDPR consent) be migrated, will give them equal ownership of the data inputs and allow them to create their own detailed planning iterations. Alternatively they can experiment with the help of a Fowler Drew adviser.

Once a plan has been created, the same underlying technology is used to manage the goal-based portfolio systematically. A goal-based portfolio is a virtual portfolio made up of specific wrappers and holdings with different legal owners contributing resources to the goal, with its own asset allocation, risk approach and customised benchmark. A systematic (or ‘quantitative’) approach is one that uses computerised decision rules rather than judgement. In our case it’s what ensures all portfolio decisions are always directly tied into each client’s unique plan.

In terms of functionality, what we’re offering will not be new for our clients. Outputs describing and quantifying goal outcomes are already used to guide changes to inputs such as resources applied to the goal, the goal’s timelines and the approach to risk. This is the means by which, at a high level, clients take responsibility for, and control, their own financial futures. Some of these high-level variables are known and finite, some are what a client needs to find out. A fully funded and realistically achievable plan is one that has internal balance between the values set for each of resources, time, risk and outcomes.

The way clients alter these variables, to the extent they have scope to alter them, directly reveals their true risk preferences and trade offs. This may seem like a simple or even obvious innovation but it requires a radically different advice process and business format as a result of the way it changes the nature of the conversation, shifts control to the clients and eliminates a role for the agent’s agenda. The payoff is that it transforms the hitherto opaque and abstract approach to determining a suitable level of investment risk into something intuitive and meaningful, with only one possible meaning for both parties. It is (as far as we know) unprecedented in the industry but is how we have been handling the suitability process for over ten years. There are objective measures to test for the benefits, such as persistency of risk approach, as well as customer survey evidence. The focus on outcomes such as spending is engaging. So is the gamification aspect of making the best possible plan which an interactive interface can do much more to encourage. In terms of the ongoing experience, it evidently boosts composure in both making choices and living with risk.

The data inputs that the Pension Dashboard envisages are not in fact high-frequency requirements. They are not necessarily going to be used to inform regular or frequent decisions and if they are, they do not contain the right information to do so. Decision making requires capital values to be re-expressed, for instance (if a retirement goal) as probable outcomes in real (after inflation) and after-tax spending amounts at different levels of confidence. It is these re-expressed values that allow clients to reveal preferences by visualising and thinking about the consequences of more or less spending or about the value they assign to different possibilities and why, because of some identified purpose or beneficiary, they assign that value. And these preferences are also always specific to the timeline, since the same payoffs from risk taking are often not valued by clients to the same extent if they arise at one age rather than another.

But the powerful data informing those choices is not limited to pensions. Pensions not subject to planned drawdown, that’s DB and state, provide underpinning to a spending plan in a form with little or no uncertainty. (These secured pensions also get applied first against personal allowances and tax bands when we convert gross cash flows into spending money.) But if choices are based on total spending outcomes probabilities, including both non-pension investments and draw from personal pensions, the combination of risky and riskless contributions to total spending will have been captured and will have influenced the revealed preferences. So also may contingent assets that our dashboard can include, such as an expected inheritance or the option of downsizing or equity release. These may also be brought into the total resources, somewhere on the timeline, to ensure the best possible spending plan is designed, by making the most satisfying use of all resources, as the client defines satisfaction.

The Pension Dashboard would be a useful source of some of the holistic data inputs we need, such as updated state and DB pension projections. Useful but not critical. And they would take out some of the cost of data collection which is often labour intensive. As discretionary managers using a platform, we find the investment data is already relatively easy to collect digitally with co-operation of all parties. But all of these data connections should be made easier even without the Pensions Dashboard idea if the new concept of ‘open banking’ were extended to the advice industry, as this is what legislates the automation of data exchanges via standardised application programme interfaces (APIs).

The FD dashboard could conceivably support an entirely digital relationship, or roboadvice, but that is not what we envisage at this stage. What we do envisage is that it will allow us to lower the economic entry point for clients, to around £200,000 of financial assets. Beyond that, the main barrier to further reductions in the entry level is our flat fee approach as this is designed to avoid cross-subsidy between clients. Breaking through the cost barrier without cross-subsidies may well require an entirely digital relationship.