Editor’s note:

In this article in 2019 we set out the reasoning behind a fee schedule for discretionary portfolio management combining an asset-based element with a flat fee varying only as a function of the nature of the goal and our quantitative solution to the problem posed by that goal. Hence ‘flatter fees’. It says a lot that this unorthodox hybrid charging model ran into flak, even though it had much logic to commend it generally and particularly when the portfolio solutions are technology driven. The flak didn’t come from existing clients so much as third parties, including other investment professionals. Their argument was that it looked confusing and, in an industry that knows how to use confusion and obfuscation, it appeared to be generating mistrust.

This is of course the very thing we were trying to avoid. In 2020 we abandoned the hybrid approach for our portfolio management service and adopted a pure asset-based fee. To keep it simple, we adopted a single rate of 0.6% (including VAT). To limit cross subsidies and prevent the dispersion of absolute fees within the firm’s clientele expanding too much, we applied a a floor and a cap in money terms (linked to inflation) based on size of assets. This approach is set out in our current fee schedule here. We have written more recently about our fee rationale, in the context of the debate between flat and asset-based fees, here. We are leaving this old post published as it contributes to the debate, as a real-world example of an attempt to resolve the issue of how best to charge for wealth management. The original article follows.

For 15 years we have operated and refined a non-traditional approach to charging investment fees, combining flat and variable elements. It’s quite specific to our goal-related and planning-based approach to organising portfolios and delivering value to clients, and it’s optimised for our ‘high-end’ target market.

But it’s also based on some general principles of what a wealth-management service costs to provide, how it’s valued and how best to align the interests of the firm with its clients.

The flaws in asset-based fees

The standard way of charging for an ongoing investment service is an asset-based fee, at a set percentage rate and (usually) drawn from the portfolio. Asset-based fees are simple to operate and clear to the client. Yet they are also a highly-inefficient means of paying for the different functions wrapped up in a private wealth management service.

Even with regressive fee scales (the percentage rate declining as portfolio size thresholds are reached), asset-based fees lead to a ‘socialist’ business model in which wealthier clients subsidise the less wealthy, allowing more clients to benefit from the service even when the fee at the firm’s ‘entry level’ is below true cost. This arises because the relationship between the portfolio size and the cost of managing it is very loose. Some wealthy people may be happy with this arrangement but it’s more likely they do not realise what’s happening. We think it’s wrong.

Asset-based fees also lead to conflicts of interest between clients and the manager. These are introduced in our video. It’s light-hearted but these are all serious flaws in the conventional business model.

A principles-based approach to charging

We started out by thinking that purely flat fees were best. We didn’t mean standard to all but certainly varying between clients only as a function of the scope, complexity and hence cost of delivering the service, and not otherwise related to levels of wealth.

From the standpoint of alignment of interests, it is easiest then to argue that a manager is economically indifferent to the client’s choices about how much of their household balance sheet to expose to capital market risk (and hence to asset-based fees) or how much and when to gift (potentially maximising their own welfare but at the expense of their manager). Clients are not incentivised to game the manager’s fee scale or conceal facts about their wealth. Managers are not incentivised to maximise assets invested in products or securities in their fee base. Clients (with our help) define their ‘utility’, or what denotes personal satisfaction, and we are paid to maximise that utility.

As we show in the video, asset-based fees are often presented as aligning the interests of clients and managers via investment performance (‘we do well when you do well and we suffer when you suffer’). This is seductive but false reasoning and that is usually revealed as soon as we start planning a goal. Risk preferences are highly idiosyncratic, specific to the goal not general to a personality, and are bound to vary between clients. The idea that a manager’s preferences, when tied by asset-based fees to the same capital-market volatility, are identical to any, let alone all, is patently absurd. It’s the right reason performance fees have not caught on in private wealth.

There is nonetheless a flaw in the reasoning that makes flat fees a function of the manager’s costs but not the value enjoyed by the client. That runs counter to how competitive product and service markets work and nobody should understand that better than investment managers. It particularly cuts across the incentives to replace labour-intensive or emotion-prone processes by quantitative, algorithm-driven processes. The payoffs from technology should be shared. We attempted to address that difference between cost and value by setting ‘license’ fees for different types of model-driven portfolio. This treated having a quantitative solution for drawdown, for instance, as much more valuable to a client than having a solution for a portfolio in accumulation.

This approach built in a loose relationship between size and fees, as drawdown portfolios tend to be larger than portfolios still at the savings stage and financial planning complexity tends to follow the size of the family wealth as well as the size of the family unit. Observing that correlation at the early stages and more recently, it has not altered much from around 70%. The residuals are sometimes explained by extreme cases, such as where a very wealthy family chooses a very simple structure for their money or a less wealthy client comes with complex investments that will take time to simplify.

Combining flat and variable charges

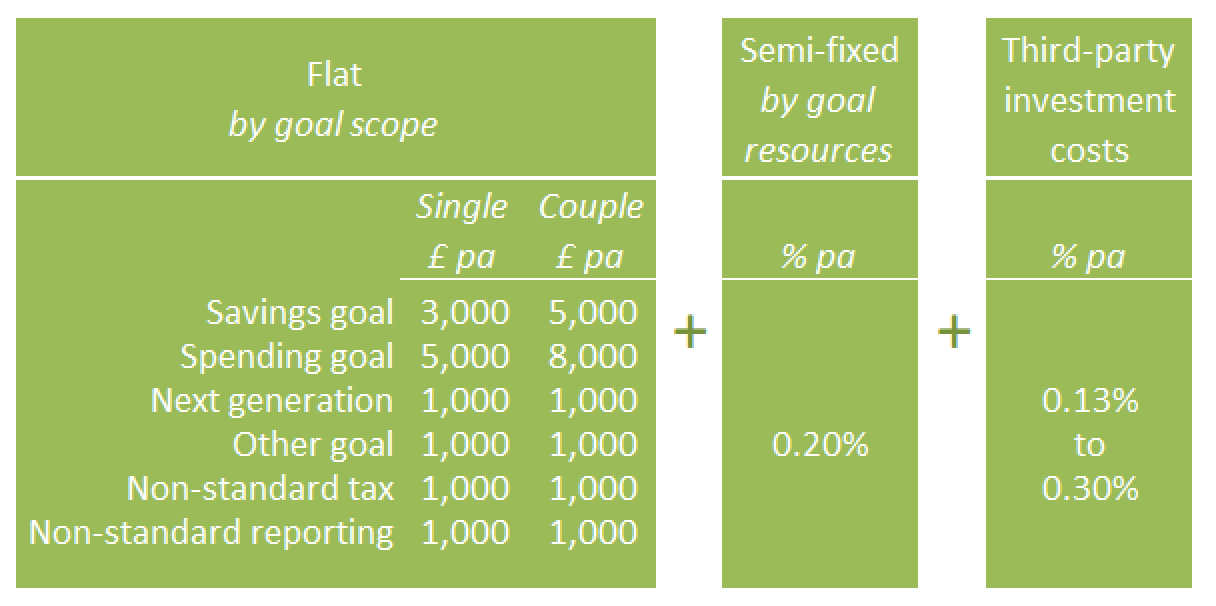

The principle of varying fees by value and using our own methodology to differentiate the fees by type of portfolio goal has been a consistent theme of our approach since we started in 2005. The scale we now operate (below) for private clients is a relatively simple way (simpler than it used to be) to express these differences.

In the table, the goal differentiation is shown by line in the first box. The scope difference, by family unit, is shown in the first two columns but ‘next generation’ portfolios for children also come into the goal structure.

In the next box, the flat rate chosen to represent the added value elements of the service is 0.20%. This is mostly about value to the client, as the direct and indirect cost element associated with portfolio size (including via our liabilities) is much smaller than this. It is made up of:

– a risk-based contribution to our EU-directed capital requirements

– regulatory fees (FCA, FOS, FSCS)

– PI insurance.

Both fee elements are subject to VAT for all UK-resident clients.

Impact of our charging approach

Two implications are very obvious:

1. The flat-rate component combined with a low value-dependent component makes for a better value proposition for wealthier clients than most other firms’ asset-based fees. We can only afford this because both components reflect cost advantages derived from adopting quantitative techniques.

2. It also pushes the entry level higher, because it prevents those cross subsidies. For simple accumulation portfolios this is around £0.5m. Below that our proposition may not be rational given expected net-of-fee rewards from risk taking. There may be ways round this that involve subsidies within the saver’s own fee stream for a number of years while building capital rapidly.

Total investment costs

Based on our 2018 actual data (for clients with only our low-cost ‘model’ assets on our preferred platform), the third fee block shows the range of third-party costs that arise in addition to our own fee. The bottom end of the range is typically larger clients in drawdown (so with less in risk assets on a platform) and benefitting from a regressive fees scale at AJ Bell (which operates our custody and dealing platform). The top end is typically a younger accumulator with 100% risk assets and with less benefit of economies of scale at AJ Bell.

Total ongoing investment costs for our clients is size-dependent because of our flatter fee approach and because of the AJ Bell mix of flat and value-based charges. It reflects our current mix of business. The median is 0.50% for our combined fees. Adding the third-party range mid-point of 0.21%, the all-in cost is 0.71%.

We doubt very much whether either this absolute or relative cost is the main reason for retaining us. Fowler Drew clients have turned their back on many features of conventional wealth management, not just the bias to high and often opaque charges revealed before they chose us (or now that EU disclosure rules are making it harder to hide the all-in ongoing costs of investing). Even the main underpinning for more competitive pricing, our adoption of technology in all our processes, is probably viewed by our clients as most beneficial because it increases their clarity, engagement and personal control rather than because it reduces costs.