This is how we updated our discretionary portfolio-management clients (by email) on the impacts of coronavirus on their goal-based portfolios. This was before the lockdown and before the full scale of the Government’s intervention in the economy was known but after large falls in global equity markets. The email refers to concepts they are familiar with and measurements that are key inputs to our modelling that they regularly see charted. These are not necessarily familiar to clients of other firms with a different investment approach. These differences are particularly instructive at times like these.

Dear…

Current Market Deviations From Trends and Your Plan

We thought it would be helpful after another hectic week for markets to put the recent falls into a historical context and to remind you about the impact on your financial plans.

As clients of Fowler Drew the impact of market movements should be different because exposures at all times, including before this event, reflect goal-specific planned outcomes and tolerances, not a view of what markets are going to do or some vague measure of risk tolerance. Making market exposures a function of desired and needed outcomes at defined dates, a feature of our adoption of institutional asset/liability modelling techniques, is still unique in private wealth management and we would like to think it is at times like these that this difference should be most valued.

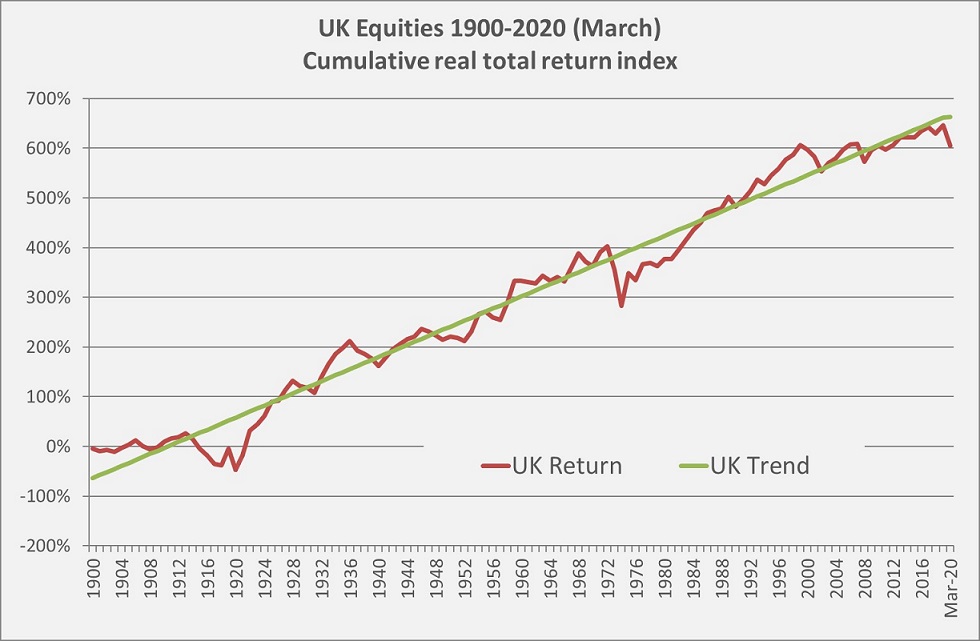

We show here a series of charts showing all of our modelled equity markets against their long-term real-return trends together with Sterling against the post-1969 average of the real exchange rate against each of the dollar, euro and yen. The latest UK equity chart is as follows.

A key input in our model that makes the connection between market conditions and projected outcomes is the deviation from trend in real total returns for an equity market. The first set of charts, like the UK’s above, shows the cumulative path of (log) real returns for each index, together with a trend fitted to that whole history. The second set shows the deviation from the trend using observed trends up to each point. Whilst the latest drop has been both sharp and deep, it cannot yet be described as an outlier in terms of deviation and hence implied future returns. The UK market is now amongst the most generous in terms of expected returns, though still not equalling extreme bear-market levels. The US is still the least generous.

As for currency, in spite of the increased volatility the deviations from our naïve estimate of purchasing power parity (as equal to the average value) are not very widely dispersed. Though sterling is close to fair value against the yen and euro, the dollar appears somewhat overvalued against all three. This is not really a currency story.

Knowing that we have not yet reached the depths of previous equity bear markets provides little comfort since it just adds credence to the view that markets could fall much further. Similarly, observing that markets are already cheap on a long-term view is of little benefit if you are no longer able to take a long-term view and must instead crystallise losses to meet spending. It is important therefore to understand what these falls mean for Fowler Drew clients’ spending plans and the extent to which further equity market declines can be tolerated before plans need to change.

For those that are in the early stages of accumulating capital, market falls are counter-intuitively more good news than bad. With the value of existing capital dwarfed by the size of anticipated future contributions, periods of low prices and above-average future returns are beneficial while they last. Whilst those who are no longer accumulating capital are no longer vulnerable to the risk of job losses, the effect of severe market downturns on their capital is likely to be more worrying.

When developing a financial plan aimed at meeting spending in retirement, your choices were informed by a portfolio construction method that revealed the range of sustainable spending levels that might result from a particular investment approach. Retirement spending plans have been built to deliver the range of outcomes that you deemed to be optimal so that we can only pursue an investment strategy that might deliver better returns, to the extent that it does not jeopardize your specified minimum tolerable spending level.

The value of planning in this way is of course dependent on two different things:

The return assumptions being realistic The calculation of the resources required to deliver the required spending amounts being based on prudent assumptions

Our return assumptions take account of the range of equity returns that have been achieved from our modelled equity markets over very long periods. The fact that we can observe more significant deviations from trend in the past tells us that what we are currently experiencing remains within the parameters of our modelling.

Having taken our return assumptions from the data histories, we then apply this to each year of your spending. If you think of each year of spending as being supported by its own mini portfolio, and the range of potential returns for each portfolio then being calculated without reference to any other, you get a very robust measure of the resources required in order to deliver the specified range of annual spending. This is a very pessimistic view of things since it goes against the key tenet of our modelling which is that equity returns will revert to a mean long-term rate. If this assumption is correct (and the charts certainly suggest that it is) then the probability of poor returns being repeated must reduce. However, we ignore this interdependence since we believe that our clients can generally afford, and do generally prefer, to base their spending choices on a very robust stress test.

Modelling in this way is important because it takes away the need to time markets successfully in order for clients’ objectives to be successfully met. What matters is less the value of your portfolio and more its purchasing power: the spending outcomes it will support. Not only is the modelling itself robust, but our clients were typically prudent in setting the tolerance levels for both sustainability (not running out, not being forced to cut spending) and worse-case outcomes. So you can and should take comfort from the fact that your spending habits are not forced to change.

When economies are being forcibly shut down to protect against a virus for which there is not yet a cure, severe market falls are unsurprising. When the economic stress is experienced alongside a very real threat to health, and we have had the comfort of our everyday routines abruptly taken away, feelings of unease and even panic are understandable. When we see Government intervention in the economy on a scale and in forms we never imagined, we are bound to ask ourselves whether economic normality can ever return. However, we should be confident that the system is adaptive, we will get through this and normality will return, even if many aspects of it are permanently altered. This too is the lesson of our long-term real return charts, as these cover many other periods of extreme stress and conceal over such a long period many large changes in economic, business and social structures. Though continuity of the system cannot ever be guaranteed, it is worth acting as if it will since there is no alternative investment and no risk free asset that will protect living standards if it does not.

If the market situation worsens before it gets better, we urge you to take comfort from knowing that your plans assumed incidents of extreme market stress so that whilst the potential for higher spending may now have been reduced, the bottom end of the forecast range remains valid. We will update everybody’s funding position for spending goals when we report the March quarter. You can expect a deterioration in funding adequacy (or confidence of achieving the targets) but well within the normal variance over the life of a plan.

As always if you wish to discuss your planning do not hesitate to get in touch. Please be patient if you have trouble getting through to us now the office is closed: send us an email and we will ring you back.

Kind regards

Chris

Head of Investment Management

David

Head of Financial Planning