This unfamiliar but telling exhibit measures the extent to which the QE-induced REAL equity risk premium has shrunk but is still much more generous than ‘normal’ (explanation below). This measure of the equity risk premium, measured against Index Linked Gilts, is the right one for any investor who has to be concerned with losses caused by inflation as much as by bad markets. Less to spend is less to spend whatever the cause. ‘Peak real risk premium’ in 2016, much later than the start of the equity bull market, helps explain the continuing strength of equities. It has also been one of the driving forces behind transfers out of ‘derisked’ final-salary schemes into personal pensions, the low breakeven year implying a very low chance of a shortfall in pension income. There is an anomaly in today’s market conditions but it isn’t the level of equity markets (merely average). It’s the high price of insuring against both equity and inflation risk.

Central banks still supporting equities

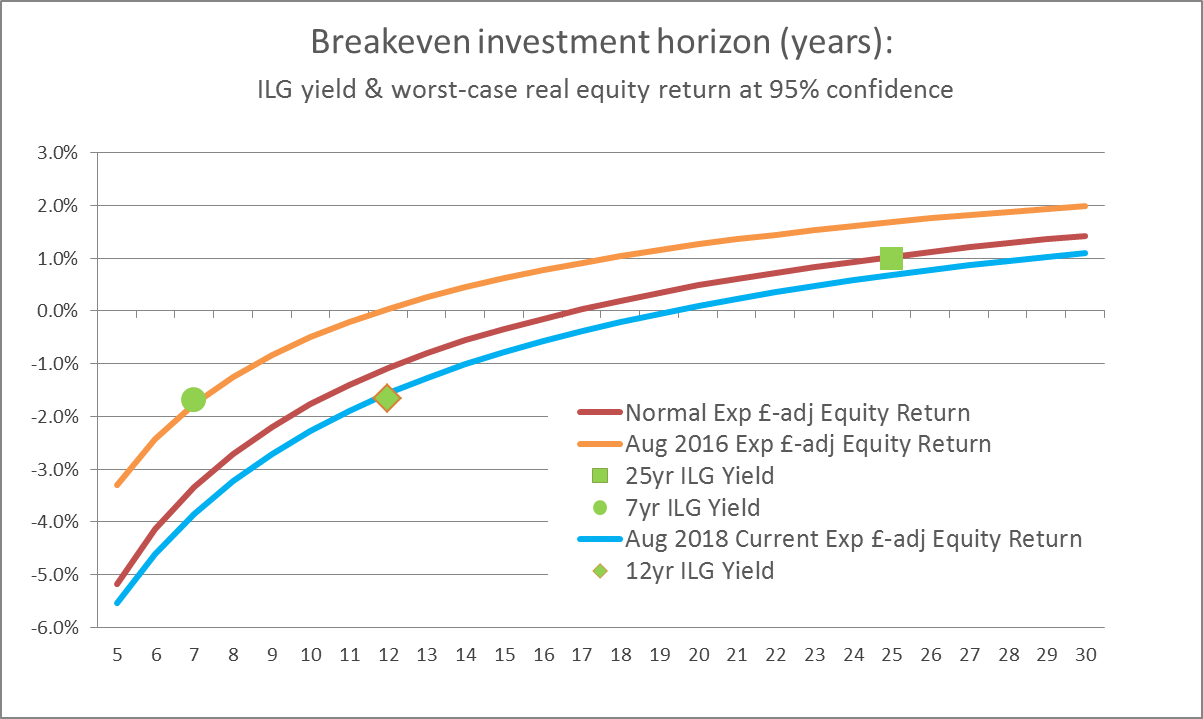

Two years ago, investors seeking a given outcome (such as £x of real spending or draw from their portfolio in year y), and choosing a risky asset portfolio over a perfectly-hedged portfolio, faced essentially no risk of shortfall relative to the hedged outcome as long as they did not need to touch the money for just 7 years (year y being more than 7 years out).

After two more years of rising equity markets, 7 years has become 12 years.

Both are well below the 25 years or so that we say is normal. Risk taking is still being encouraged by the high cost (in reduced returns or higher required resources) of avoiding risk.

When we showed this in a blog in August 2016 we suggested that the equity risk premium was higher than at any time other than extreme bear markets, noting that on this occasion it was not caused by very low equity prices but rather by very low real interest rates. That after all was one of the intentions of Quantitative Easing: to use interest rates, which the Government can control, to try to temper the post credit-crisis aversion to taking risk and encourage what Keynes referred to as ‘animal spirits’. Though the authorities could influence equities they couldn’t control them – and other domestic factors such as Brexit might seem to have pointed in the opposite direction, discouraging animal spirits. But in fact the risk premium has prevailed and the FTSE All Share Index has returned 23% (including dividends) since then.

Similar attempts to manage confidence via QE have occurred on broadly similar and equally unprecedented scales in Europe, Japan and the US and so the UK’s performance does not stand out (except perhaps as below average). The Fowler Drew equity portfolio, diversified across the major developed and developing markets, is up slightly more than one third over this two-year period.

A portfolio-orientated measure of the risk premium

Clients of Fowler Drew with drawdown plans for retirement spending see regular projections of probable spending outcomes for every year of draw. That is how they plan, and replan, the level and profile of their draw so as to gain maximum satisfaction (as they get to define it) from all the resources available to support spending. At a very high level, they are also familiar with the notion that every year of draw has its own risk free rate (given by an Index Linked Gilt with the same duration) and its own range of expected equity returns. The size of the range, or ‘probability distribution’, is a function of time; the mean of the distribution is a function of market conditions – high markets being associated with low future returns and vice versa. In a Fowler Drew portfolio risk is controlled, and matched to individual tolerances of ‘real loss’ or ‘shortfall’, by altering the mix of risk free ‘hedges’ and equity ‘bets’. Though this happens within the individual years’ asset allocations, they then get reported as a single goal-based asset split, between risky and risk free assets.

Given this portfolio approach, the appropriate measure of the relative returns, or risk premium, for each horizon is therefore made up of the current ILG yield and the expected real return in sterling terms of the Fowler Drew optimised, global equity portfolio. This equity return combines a model for local-currency returns from each constituent market and a model for the real exchange rate for each currency against sterling. These are the model data outputs the chart captures.

How to read the chart

The breakeven investment horizon is the number of years from today (measured from left to right) at which the worst-case expected equity real return is above the risk free return provided by a horizon-matched Index Linked Gilt (ILG). By worst-case we mean that 95% of the returns predicted by the Fowler Drew equity model are above this level.

Normal conditions

Normally the breakeven horizon is about 25 years out – in other words equity returns are so uncertain that you need very long time horizons to be sure of avoiding a shortfall relative to the risk free return. It is the high chance of loss that gives the ‘risk premium’ its name. In the chart, the expected real equity return at the 95% confidence level (left scale, % pa) has an upward curve (the orange, red and blue lines). The curve reflects the assumption in our model that markets have a positive trend (about 6% pa) and revert over time to that trend. The risk of loss declines with time, not because outcome risk reduces with time but because it expands at a slower rate than the mean growth rate.

These are observations based on empirical data. They do not need any explanatory theory of market behaviour or equilibrium economics, even though there almost certainly is a theoretical explanation. The normal risk free return, as close as you can get to a measure of the pure time value of money, is assumed to be 1% (the green square). This is elusive in terms of empirical observations (because of the short history of inflation-linked bonds) so requires an assumption which is somewhat theoretical.

The normal breakeven year in terms of avoiding a negative return is therefore shorter (0% being an easier target to beat than 1%), at about 19 years. The risk of absolute loss is intuitive but unrealistic as it ignores any opportunity cost, such as the cash return or true risk free return.

2016: peak premium

When we reviewed it exactly two years ago, the effect of Quantitative Easing was to shorten the breakeven year to about 7 years (given by the location of the green circle). This reflected negative ILG yields. The breakeven year for avoiding an absolute loss was only slightly higher at 11 years. Negative ILG yields and undervalued equities created an exceptionally low risk of both absolute and relative loss at unusually short horizons.

(The relevance for transfers from Defined Benefit to Defined Contribution pensions was that many company schemes had permanently ‘derisked’ their portfolios, for accounting and regulatory reasons), and then only held assets that guaranteed the cash flows given by the promised pensions. The resulting portfolio would have many of the characteristics of an ILG with the same duration, or average time horizon, as the cash flows. Since cash values offered to a transferring member are required by regulation to reflect the expected earnings on the actual assets held, the values, equivalent to the resources required, needed to be high to meet a fixed outcome in the form of the guaranteed pension if the return was very low or even negative. This does not mean the transfer values were ‘generous’, just fair according to the rules.)

Current conditions

The blue line shows the most recent data. The first thing to note is that equity market returns have reverted to very close to what we call normal market conditions. The blue curve is close to the red curve. This is currently made up of sterling being undervalued on a purchasing power parity basis (a function of the of the EU referendum) and world equity markets being somewhat above trend, but not to any degree predictive of substantially lower than normal long-term returns. Though Bank Rate has started to move up, ILG yields have remained broadly the same across all maturities. (The profile of ILG yields at different maturities is generally much flatter than nominal gilt yields which may at times curve up, curve down or ‘hump’.) The result is that the breakeven year, denoted by the green diamond, has moved out to about 12 years.

The first year in which there is a less than 5% chance of negative absolute return is now 19 years, up from 11 two years ago. This risk of absolute loss is in fact broadly normal, i.e. the blue and red lines cross zero at roughly the same point. The underlines the observation that the true anomaly in market conditions is not the level of the equity markets but the level of Government-manipulated real bond yields, the green markers in both 2016 and today being nearly 3% below the level that an economy might normally need and expect. It is not sustainable.

What’s the significance of 95%?

I’ve chosen to show the breakeven years based on 95% confidence. 95% is appropriate as a ‘stress test’ in any situation in which falling short of some minimum outcome would be a source of regret or hardship. Some clients prefer (if they can afford it, or if we see they really cannot tolerate any shortfall against a target outcome) to fund their spending plans at 99% confidence, which is as high as any model can realistically quantify probabilities. But a model is only a model, so it’s still an estimate and not the same as a guarantee.

Pascal’s Wager

One of the features that makes 95% a robust stress test in practice is that we are independently funding each year’s spending, as if every year in the plan could suffer the worst-case investment result. For that to happen over a long-lived plan, without any reversion to trend, is close to implying the end of the capitalist system that delivers these trend returns and that provides an equity risk premium.

I liken this insight to Pascal’s Wager: if you are not sure the system will survive but you realise that every alternative investment, including notionally risk free investments, is lost if the system does not survive, you might as well act as though fully confident it will survive. This wager may not be available to all investors, notably occupational pension funds (witness the current dispute at the Universities Superannuation Scheme). But it is absolutely available to private individuals. That is another insight: play to your natural advantages within the market.